Story by Connor Danielowski / January 22, 2026

For many healthcare practices, Chronic Care Management (CCM) represents a significant opportunity for recurring Medicare revenue. But that opportunity comes with a critical caveat: revenue is only as strong as compliance allows.

In CCM, revenue integrity isn’t just about billing more. It’s about ensuring every dollar billed is defensible, compliant, and sustainable under CMS scrutiny. Practices that overlook this balance often leave money unclaimed—or worse, expose themselves to audits and reimbursement clawbacks.

Revenue integrity ensures that CCM programs generate maximum reimbursement without risking CMS violations.

Revenue integrity in CCM sits at the intersection of:

It ensures that:

Without revenue integrity, CCM programs often suffer from:

CCM is regulated by the Centers for Medicare & Medicaid Services and requires strict adherence to billing and documentation standards.

At a minimum, CMS requires:

Missing just one of these elements can make an otherwise valid CCM claim non-billable.

Many practices assume that if claims are being paid, their CCM program is compliant.

That assumption is risky.

Common revenue leaks include:

These gaps often don’t surface until:

Revenue integrity ensures that what you do, what you document, and what you bill all align perfectly.

Read our blog on “Money Left on the Table”: How to Capture Untapped Medicare Revenue Through CCM (CPT Codes 99490 & 99439)

Some practices view compliance as a constraint that limits billing.

In reality, compliance enables full reimbursement.

When CCM programs are built with compliance first:

Practices with strong revenue integrity often bill more, not less—because nothing falls through the cracks.

Read about the New CMS Chronic Care Management Reimbursement Rules

Maintaining CCM revenue integrity internally requires:

Outsourced CCM programs are designed specifically to manage this complexity.

They typically provide:

This reduces internal risk while ensuring maximum allowable reimbursement under CMS rules.

A CCM program should be built as if it will be audited—because eventually, many are.

Revenue integrity ensures that if CMS requests records, the practice can produce:

When documentation is clean and complete, audits become routine—not disruptive.

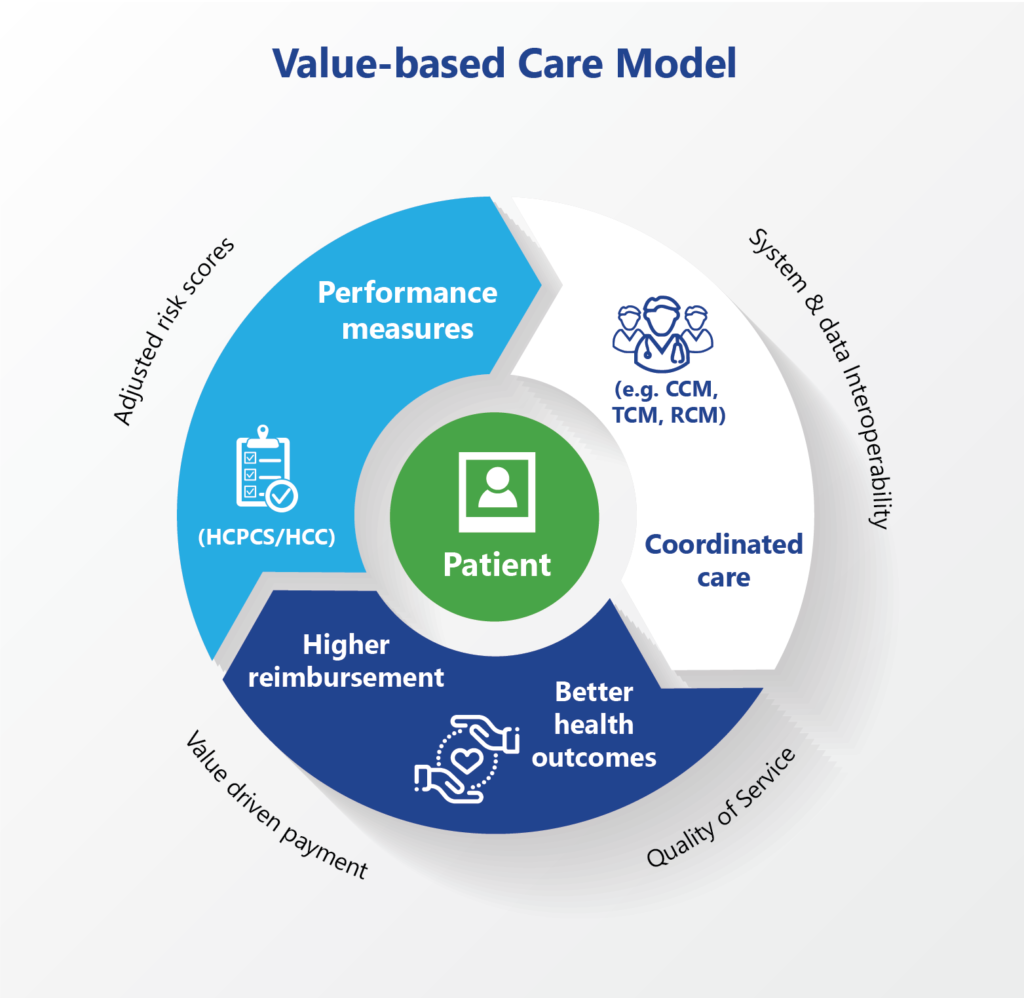

CCM revenue isn’t just about short-term gains. For many practices, it becomes a foundational pillar of value-based care.

Strong revenue integrity allows practices to:

This creates a program that grows without increasing risk exposure.

In Chronic Care Management, revenue integrity is the difference between growth and vulnerability.

Practices that prioritize CMS compliance don’t just protect themselves—they unlock the full financial potential of CCM with confidence.

By aligning documentation, care delivery, and billing under a compliance-first framework, CCM becomes a reliable, scalable, and audit-ready revenue stream.

GET IN TOUCH